JOHNSTON, Iowa — Pioneer® brand corn and soybeans excelled in on-farm trials harvested this season, delivering consistent yield advantages over competitive products across all environments. Pioneer brand products achieved even greater yield advantages under many of this season’s stressful growing conditions. At recent commodity prices of $5.93/bu for corn and $12.46/bu for soybeans,1 these yield advantages are helping create strong income opportunities for farmers.

“Farmers need solutions they can trust to help maximize yield potential and profitability on every acre — it’s why we rigorously test each Pioneer brand product, including every one of our most popular products in on-farm trials,” said Judd O’Connor, President, U.S. Commercial Business, Corteva Agriscience. “This data enables us to transfer insights from trials to farmers’ fields.”

Leading R&D Equips Pioneer Brand Corn to Thrive in Challenging Environments

The Corn Revolution has enabled Pioneer breeders to more efficiently search and screen the Corteva Agriscience global gene library to create exclusive Pioneer brand corn products in the U.S. The result is a diverse product lineup with the agronomic characteristics that deliver yield despite growing conditions.

“This season, growers faced challenges that included increased corn rootworm pressure, persistent drought and outbreaks of disease,” said Luis Verde, North American Corn Product Development Lead, Corteva Agriscience. “While Pioneer brand products showed advantages across all environments, it was in some of this season’s most difficult conditions where Pioneer brand corn best demonstrated its competitive advantage.”

The performance from the 2021 advancement class, which included 43 new products from 26 new genetic platforms, was exceptionally impressive. “This past year’s new hybrids — all products of the Corn Revolution — delivered the first year in the field with an average 6.1 bu/A yield advantage,2 which we are excited to learn from and build on in the coming years,” Verde said. Top performers included:

- Pioneer® P0924Q™ brand corn with a 9.3 bu/A yield advantage

- Pioneer® hybrid P1718VYHR with a 10.3 bu/A yield advantage

- Pioneer® P9540AM™ brand corn with an 8.1 bu/A yield advantage

- Pioneer® P9823Q™ brand corn with a 11.3 bu/A yield advantage

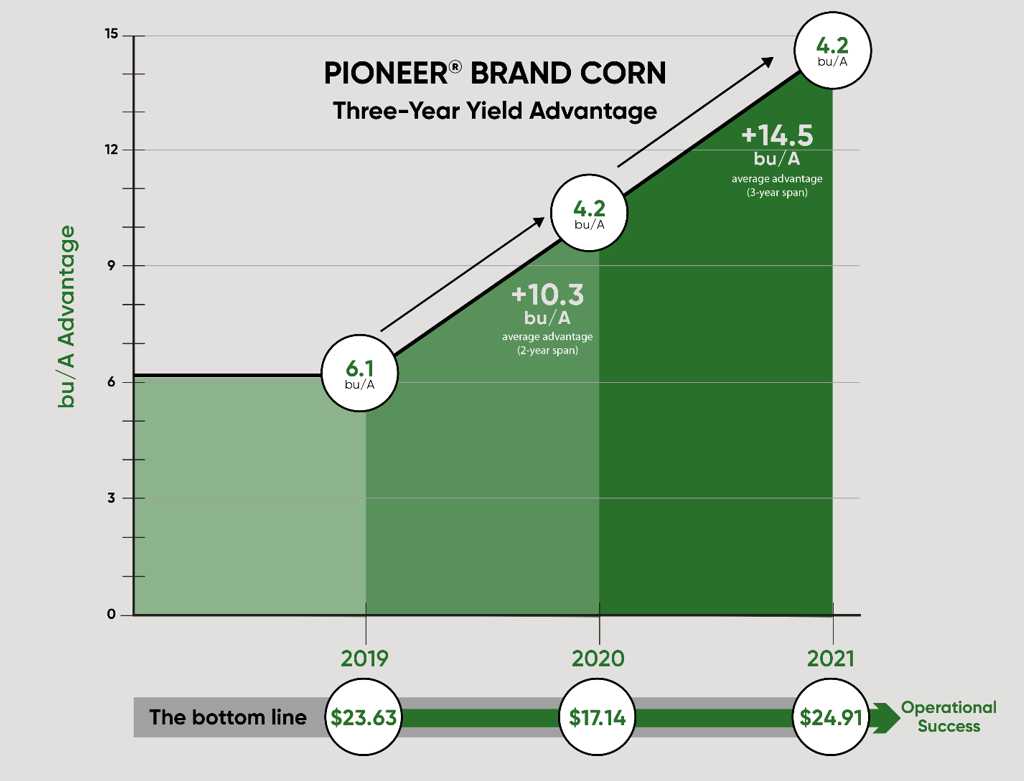

The 40 most popular Pioneer brand corn products by sales volume averaged a 4.2 bu/A yield advantage2 over the competition in more than 10,000 on-farm comparisons across all environments. This equates to $24.91/A in potential additional farm income.1

Pioneer® brand Qrome® products, which feature two modes of action to defend against corn rootworm pressure, averaged an impressive 6.2 bu/A yield advantage this season over competitive SmartStax® technology.2 This equates to $36.77/A in potential additional farm income.1 Qrome products with superior advantages over SmartStax® technology include:

- Pioneer® P0720Q™ brand corn with a 9.8 bu/A yield advantage

- Pioneer® P0075Q™ brand corn with an 8.7 bu/A yield advantage

- Pioneer® P0404Q™ brand corn with a 7.4 bu/A yield advantage

Many western U.S. corn-growing states continued to experience persistent drought conditions this season. Pioneer® brand Optimum® AQUAmax® hybrids are bred to include key native traits that are designed to improve root system and silk emergence, among other agronomic characteristics, to help manage drought stress. In 2021, Optimum AQUAmax hybrids had a 5.8 bu/A yield advantage across all growing environments.2

The robust agronomics of Pioneer products are built to tolerate a range of diseases, and their overall plant health was on display this year. Large portions of the eastern Corn Belt saw severe outbreaks of tar spot disease, a foliar fungal disease, which can cause significant yield loss in susceptible corn hybrids. In the most heavily impacted areas, Pioneer products excelled with a 7.7 bu/A yield advantage.2

Premium seed treatments also contributed to yield advantages in fields experiencing stressful conditions, such as corn nematode pressure. Lumialza™ nematicide seed treatment provides more than 80 days of root protection in upper, middle and lower root zones against plant parasitic nematodes and can add a 3.7 bu/A yield advantage3 under low nematode pressure and up to 9 bushels under high nematode pressure.

Pioneer® Brand Enlist E3® Soybeans Growing Yield Advantages and Market Share

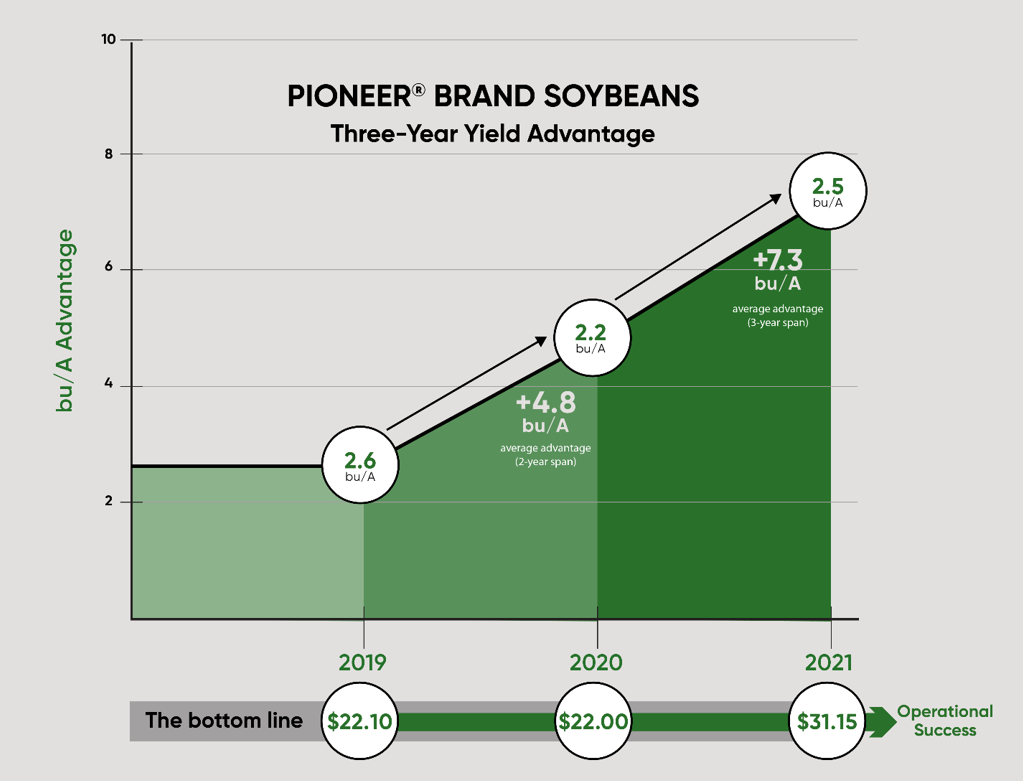

Overall soybean product performance was exceptionally strong in nearly 3,200 competitive on-farm comparisons. The top 40 Pioneer brand soybean products by demand demonstrated a yield advantage 66% of the time, with a 2.5 bu/A yield advantage,4 resulting in a $31.15/A potential additional income advantage.1

“We are excited about how Pioneer brand Enlist E3 soybeans delivered this season,” said Jeff Thompson, Global Soybean Research Lead, Corteva Agriscience. “Enlist E3 technology is firmly established, and farmers planting Pioneer brand Enlist E3 soybean products can count on a decade of expertise to support them in adopting this superior weed control system.”

Enlist E3 soybeans now have approximately 35% of the total U.S. soybean market, and early indications on farmer demand for Enlist E3 soybeans in 2022 is trending higher than expected.

Pioneer brand Enlist E3 soybeans are delivering a 3.0 bu/A yield advantage5 and outperforming 70% of the time versus Asgrow® XtendFlex® soybeans, including:

- Pioneer® P31T64E™ brand soybeans with a 3.3 bu/A yield advantage

- Pioneer® P29T37E™ brand soybeans with a 3.2 bu/A yield advantage

- Pioneer® P42T31E™ brand soybeans with a 3.0 bu/A yield advantage

- Pioneer® P38T05E™ brand soybeans with a 2.6 bu/A yield advantage

- Pioneer® P28T02E™ brand soybeans with a 2.3 bu/A yield advantage

“The yield advantages from our on-farm trials against Asgrow® XtendFlex® soybeans would result in a $37.38/A potential additional income advantage with Pioneer brand varieties,” Thompson said. “This is just the beginning. Farmers planting Pioneer brand Enlist E3 soybean varieties can continue to expect a robust pipeline of products that help maximize yield potential and profitability on their farms.”

Next season also brings the availability of the new Lumiderm® insecticide seed treatment, which shields soybean seedlings against twice the number of insect species when compared with Gaucho® seed treatment. In multiyear trials, Lumiderm can add a 1 to 2 bu/A yield advantage.6

Farmers who would like to analyze the performance of their own acres at a subfield level and easily compare yield by hybrid choice, soil type, planting date and other variables can do so for free through Granular® Insights™.

About Pioneer

Pioneer, the flagship seed brand of Corteva Agriscience, is the world’s leading developer and supplier of advanced plant genetics, providing high-quality seeds to farmers in more than 90 countries. Pioneer provides agronomic support and services to help increase farmer productivity and profitability and strives to develop sustainable agricultural systems for people everywhere.

Join the discussion and follow Pioneer on Facebook, Twitter, Instagram and YouTube.

About Corteva Agriscience

Corteva, Inc. (NYSE: CTVA) is a publicly traded, global pure-play agriculture company that provides farmers around the world with the most complete portfolio in the industry – including a balanced and diverse mix of seed, crop protection and digital solutions focused on maximizing productivity to enhance yield and profitability. With some of the most recognized brands in agriculture and an industry-leading product and technology pipeline well positioned to drive growth, the company is committed to working with stakeholders throughout the food system as it fulfills its promise to enrich the lives of those who produce and those who consume, ensuring progress for generations to come. Corteva Agriscience became an independent public company on June 1, 2019, and was previously the Agriculture Division of DowDuPont. More information can be found at www.corteva.com.

Follow Corteva Agriscience on Facebook, Instagram, LinkedIn, Twitter and YouTube.

# # #

Media Contact:

Kacey Birchmier

515-305-0085 cell

kacey.birchmier@corteva.com

Farmers planting one of the top 40, by demand, Pioneer® brand corn products have seen on average a cumulative 14.5 bu/A yield advantage2 over a three-year period versus competitive products.

Farmers planting one of the top 40, by demand, Pioneer® brand soybean products over the last three years have seen on average a $25.08/A income advantage1 over competitive products.

1Income/A advantage is calculated with the price of corn at $5.93 per bushel and with the price of soybeans at $12.46 per bushel as of Oct. 20, 2021.

2Data is based on an average of 2021 comparisons made in the United States through Oct. 26, 2021. Comparisons are against all competitors, technology segment matched, unless otherwise stated, and within a +/- 3 CRM of the competitive brand.

3Data is based on a 10-state broad-acre head-to-head strip trial comparing Lumialza™ nematicide seed treatment versus non-nematicide seed treatment utilizing the same insecticide and fungicide recipe in seed-applied technology replicated in strip trial data. Yield ranged from 3 to 9 bu/A depending on nematode species and population, in 184 low-stress and 54 moderate- to high-stress locations.

4Data is based on an average of 2021 comparisons made in the United States through Oct. 18, 2021. Comparisons are against all competitors, unless otherwise stated, and within +/- 0.3 RM of the competitive brand.

5Data is based on an average of 2021 on-farm and IMPACT™ trial comparisons made in Arkansas, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maryland, Michigan, Minnesota, Nebraska, North Dakota, Ohio, Pennsylvania, South Dakota, Tennessee and Wisconsin through Oct. 31, 2021. Comparisons are against any number of products of the indicated competitor brand, unless otherwise stated, and within +/- 0.3 RM of the competitive brand.

6Significant yield improvement and reduction in plant stand gaps based on Corteva Agriscience research data in 73 locations.

Product performance is variable and subject to any number of environmental, disease and pest pressures. Individual results may vary and from year to year and prior performance is not a guarantee of future performance. Multi-year and multi-location data are a better predictor of future performance. DO NOT USE THIS OR ANY OTHER DATA FROM A LIMITED NUMBER OF TRIALS AS A SIGNIFICANT FACTOR IN PRODUCT SELECTION. Refer to www.pioneer.com/products or contact a Pioneer sales representative or authorized dealer for the latest and complete listing of traits and scores for each Pioneer® brand product. Pioneer® brand products are provided subject to the terms and conditions of purchase which are part of the labeling and purchase documents. Product label instructions must be followed at all times. No offer for sale, sale or use of these products are permitted prior to issuance of the required country, region or state registrations.

SmartStax® multi-event technology developed by Corteva Agriscience and Monsanto. Asgrow®, XtendFlex®, SmartStax® and the SmartStax Logo are registered trademarks of Bayer Group.

Liberty®, LibertyLink® and the Water Droplet Design are trademarks of BASF.

Agrisure® and Agrisure Viptera® are registered trademarks of, and used under license from, a Syngenta Group Company. Agrisure® technology incorporated into these seeds is commercialized under a license from Syngenta Crop Protection AG. Roundup Ready® is a registered trademark used under license from Monsanto Company.

Qrome® products are approved for cultivation in the U.S. and Canada. They have also received approval in a number of importing countries, most recently China. For additional information about the status of regulatory authorizations, visit http://www.biotradestatus.com/.

Lumiderm® is not registered for sale or use in all states. Contact your state pesticide regulatory agency to determine if a product is registered for sale or use in your state. Always read and follow label directions.

Gaucho® is a registered trademark of Bayer CropScience.

The transgenic soybean event in Enlist E3® soybeans is jointly developed and owned by Corteva Agriscience and M.S. Technologies L.L.C.<

™ ®Trademarks of Corteva Agriscience and its affiliated companies.

Cautionary Statement About Forward-Looking Statements

This communication contains forward-looking statements and other estimates within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended, which are intended to be covered by the safe harbor provisions for forward-looking statements and other estimates contained in the Private Securities Litigation Reform Act of 1995, and may be identified by their use of words like “guidance”, “plans,” “expects,” “will,” “anticipates,” “believes,” “intends,” “projects,” “estimates,” “outlook,” or other words of similar meaning. All statements that address expectations or projections about the future, including statements about Corteva’s strategy for growth, product development, regulatory approval, market position, anticipated benefits of recent acquisitions, timing of anticipated benefits from restructuring actions, outcome of contingencies, such as litigation and environmental matters, expenditures, and financial results, as well as expected benefits from, the separation of Corteva from DowDuPont, are forward-looking statements.

Forward-looking statements are based on certain assumptions and expectations of future events which may not be accurate or realized. Forward-looking statements also involve risks and uncertainties, many of which are beyond Corteva’s control. While the list of factors presented below is considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on Corteva’s business, results of operations and financial condition. Some of the important factors that could cause Corteva’s actual results to differ materially from those projected in any such forward-looking statements include: (i) failure to obtain or maintain the necessary regulatory approvals for some of Corteva’s products; (ii) failure to successfully develop and commercialize Corteva’s pipeline; (iii) effect of the degree of public understanding and acceptance or perceived public acceptance of Corteva’s biotechnology and other agricultural products; (iv) effect of changes in agricultural and related policies of governments and international organizations; (v) effect of competition and consolidation in Corteva’s industry; (vi) effect of competition from manufacturers of generic products; (vii) costs of complying with evolving regulatory requirements and the effect of actual or alleged violations of environmental laws or permit requirements; (viii) effect of climate change and unpredictable seasonal and weather factors; (ix) risks related to oil and commodity markets; (x) competitor’s establishment of an intermediary platform for distribution of Corteva's products; (xi) impact of Corteva’s dependence on third parties with respect to certain of its raw materials or licenses and commercialization; (xii) effect of industrial espionage and other disruptions to Corteva’s supply chain, information technology or network systems; (xiii) effect of volatility in Corteva’s input costs; (xiv) failure to realize the anticipated benefits of the internal reorganizations taken by DowDuPont in connection with the spin-off of Corteva and other cost savings initiatives; (xv) failure to raise capital through the capital markets or short-term borrowings on terms acceptable to Corteva; (xvi) failure of Corteva’s customers to pay their debts to Corteva, including customer financing programs; (xvii) increases in pension and other post-employment benefit plan funding obligations; (xviii) risks related to the indemnification obligations of legacy EID liabilities in connection with the separation of Corteva; (xix) effect of compliance with laws and requirements and adverse judgments on litigation; (xx) risks related to Corteva’s global operations; (xxi) failure to effectively manage acquisitions, divestitures, alliances and other portfolio actions; (xxii) risks related to COVID-19; (xxiii) risks related to activist stockholders; (xxiv) Corteva’s intellectual property rights or defend against intellectual property claims asserted by others; (xxv) effect of counterfeit products; (xxvi) Corteva’s dependence on intellectual property cross-license agreements; (xxvii) other risks related to the Separation from DowDuPont; (xxvii) risks related to the Biden executive order Promoting Competition in the American Economy; and (xxix) risks associated with our CEO transition. Where, in any forward-looking statement, an expectation or belief as to future results or events is expressed, such expectation or belief is based on the current plans and expectations of Corteva’s management and expressed in good faith and believed to have a reasonable basis, but there can be no assurance that the expectation or belief will result or be achieved or accomplished. Corteva disclaims and does not undertake any obligation to update or revise any forward-looking statement or other estimate, except as required by applicable law. A detailed discussion of some of the significant risks and uncertainties which may cause results and events to differ materially from such forward-looking statements or other estimates is included in the “Risk Factors” section of Corteva’s Annual Report on Form 10-K, as modified by subsequent Quarterly Reports on Forms 10-Q and Current Reports on Form 8-K.